An agreement for US firm Google to

pay £130m in UK back taxes has been criticised as "derisory" and

labelled a "sweetheart deal" by critics.

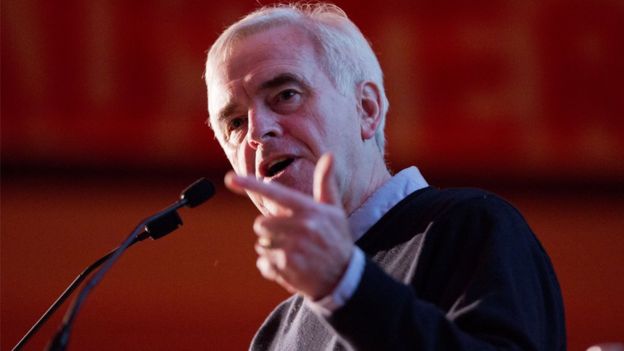

The payment covers money owed since 2005 and follows a six-year inquiry by Her Majesty's Revenue and Customs.The government hailed "a victory", but shadow chancellor John McDonnell said the figure was "relatively trivial".

Labour MP Meg Hillier, chair of the public accounts committee, said it was "a small amount of money" for Google.

The tax agreement comes after years of criticism of Google and other multinational firms over their tax arrangement in the UK and across Europe.

Google agrees £130m UK tax deal

Who wins from Google tax?

Mr Osborne described the agreement as a "victory" for action on tax avoidance, saying: "We now expect to see other firms pay their share."

However, speaking to BBC Radio 4's Today programme, Labour's Mr McDonnell called for greater transparency about how the deal had been reached.

"HMRC seems to have settled for a relatively small amount in comparison with the overall profits that are made by the company in this country. And some of the independent analysts have argued that it should be at least ten times this amount," he said.

'Relatively trivial'

Mr McDonnell said he would raise the issue in Parliament next week and called for the deal to be investigated by the public spending watchdog."It looks to me from all the independent analysis that this is relatively trivial in comparison with what should have been paid. In fact one analysis has put the rate down to about 3%, which I think is derisory," he added.

Conservative MP Mark Garnier, a member of the Treasury select committee, said the agreement represented a "relatively small" amount of money compared with Google's UK profits.

Ms Hillier labelled the agreement a "cosy deal", saying she would call Google and HMRC before MPs on the Common's Public Accounts Committee to explain the deal.

The deal showed HMRC had admitted collecting "too little tax from Google for nine out of 10 years", she added.

Margaret Hodge, the Labour MP and former chair of the same committee, said HMRC had "a duty" to explain details of the agreement.

The government needed to "assure us that everyone is treated fairly before the law and confidence in tax system is restored", she added.

'Google tax'

Despite the UK being one of Google's biggest markets, it paid £20.4m in taxes in 2013.The value of its sales in Britain that year was £3.8bn. Google makes most of its UK profits through online advertising here.

In March's Budget, Chancellor George Osborne announced the introduction of a so-called "Google tax" targeting firms that move their profits overseas.

Google has its European headquarters in Ireland, which has a lower corporation tax rate than the UK. It has also used company structures in Bermuda, where the corporation tax rate is zero, to shelter profits.

Such moves are legal and Google - a US business, which pays the majority of its taxes there - says it has abided by international tax rules.

Matt Brittin, head of Google Europe, told the BBC: "Today we announced that we are going to be paying more tax in the UK.

"The rules are changing internationally and the UK government is taking the lead in applying those rules so we'll be changing what we are doing here. We want to ensure that we pay the right amount of tax."

An HMRC spokesman said: "The successful conclusion of HMRC enquiries has secured a substantial result, which means that Google will pay the full tax due in law on profits that belong in the UK.

"Multinational companies must pay the tax that is due and we do not accept less."

BBC

YEMI

0 comments:

Post a Comment